Markit Recap – 7/17/2017

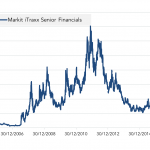

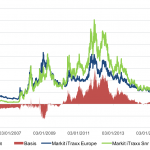

Senior Financials dips below 50bps Few would question the supportive role Mario Draghi has played over the last six years. Under his presidency, the ECB quickly reversed the ill-advised rate hikes in 2011 and subsequently loosened policy – the refinancing rate has been at or close to zero since 2014…. Subscribe to Read MoreAlready a