The Pulse of Private Equity – 6/12/2017

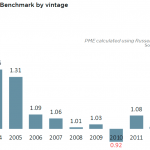

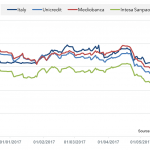

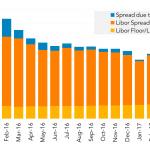

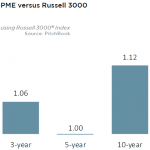

Is this the new normal for buyout firms? View PitchBook’s 2017 Global PE Deal Multiples Report: Part II Here Multiple datasets can help convey certain aspects of why the current private equity environment may represent a new normal in terms of dealmaking, yet one of the more telling is one that depicts the type of the…