Leveraged Loan Insight & Analysis – 2/13/2017

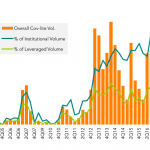

Covenant-lite volume will likely hit another record high in 1Q17

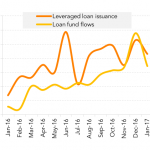

Covenant-lite loan volume has already reached US$90 bn in 1Q17 with two more months still left to go this quarter. With another US$35bn still in process, 1Q17 will likely be a brand new record high for covenant-lite issuance. Covy-lite volume had just hit a brand new record high last quarter at US$128bn, smashing the previous record set in 1Q14. These robust volumes are largely taking place during big refinancing waves like in the current environment...