Markit Recap – 1/2/2017

John Maynard Keynes said we live in a world of irreducible uncertainty, while neoclassical economists state that perfect information is available and people make rational expectations. The events of the last decade suggest that the former school of thought has more credence, though “freshwater” economists would no doubt disagree.

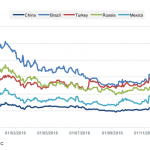

Uncertainty of the political variety looks set to be the overriding theme for 2017, regardless of whether one thinks the market is driven by rational agents or not. A new US president promising radical policy changes; elections in France, Germany and the Netherlands...