Private Debt Intelligence – 12/5/2016

The Lead Left: Asia-Focused Funds in Market

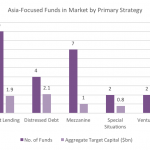

Preqin’s Private Debt Online database currently tracks 24 private debt funds in market with a primary geographic focus on Asia. Collectively, they are targeting $5.9bn of investor capital with an average target size of $283mn.

Of the five largest funds in market, three are opting to make direct lending investments and the remaining two are choosing to target special situations and distressed debt opportunities. It is interesting to note that although there are only four distressed debt funds in market...