Leveraged Loan Insight & Analysis -9/19/2016

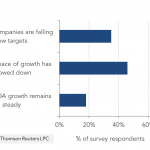

Lender Survey: Are you seeing cracks in your portfolio? Yes, we are seeing signs of cracks in credit quality in our portfolios, said roughly 35% of the attendees gathered at the Marriott in Times Square for Thomson Reuters LPC’s 22nd Annual Loan & CLO Conference on Thursday. While these respondents said some companies are falling…