Preqin Private Debt Intelligence – 9/5/2016

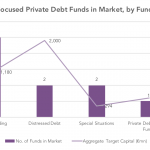

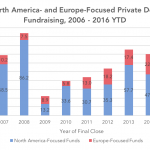

Is the Italy-Focused Private Debt Industry Set for Growth? The Italy-focused private debt market remains in its infancy – only 13 funds focused on the country have closed since 2004 raising a total €2.6bn – however recent legislative changes announced by Italian Prime Minister, Matteo Renzi, may be about to accelerate growth in the country….