Leveraged Loan Insight & Analysis – 8/1/2016

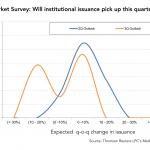

Flex activity continued to favor issuers in July Market sentiment in July was more of the same in the leveraged institutional market. Although deal flow thinned out from a swell of volume in June, negotiations continued to favor issuers. Thomson Reuters LPC’s Flex Factor scored a -0.04 for July,… Subscribe to Read MoreAlready a member?