Leveraged Loan Insight & Analysis – 6/22/2015

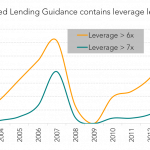

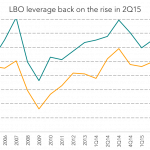

Halfway through 2015 and Leveraged Lending Guidance continues to keep leverage levels under control on buyout deals. The share of deals with leverage of seven times or greater has plummeted in 1H15 to only 5.7% from 26% last year. The share of deals levered greater than 7 times peaked in 2007 at almost 40%…. Subscribe to