Leveraged Loan Insight & Analysis – 5/4/2015

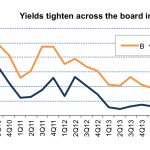

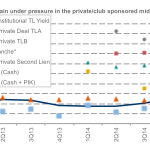

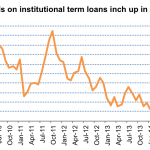

The average yield on first-lien institutional loans is in the 5.18 percent context so far in 2Q15, down from 5.78 percent in 1Q15. After widening above the 6 percent threshold in 4Q14, yields have declined this quarter as demand continues to outstrip supply in the leveraged loan market…. Subscribe to Read MoreAlready a member? Log in