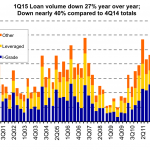

Leveraged Loan Insight & Analysis – 4/20/2015

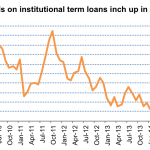

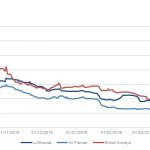

Yields on institutional term loans have inched higher so far in April, after dropping in March. The average yield, assuming a three-year term to repayment is 5.66 percent in April, up from 5.28 percent in March. Still April levels are below the 6 percent threshold,… Subscribe to Read MoreAlready a member? Log in here...