Markit Recap – 1/5/2015

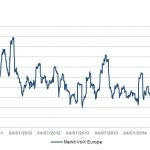

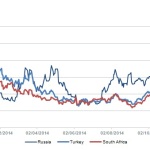

It seems like an aeon ago that a relatively small country in south-eastern Europe held the fortunes of the global economy in its hands. But less than two years has passed since Greece’s debt was restructured, and it is all too apparent that the sovereign still has the capacity to create a noise that belies its modest…