DL Deals: News & Analysis – 2/6/2023

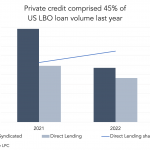

Benign decline: Volume eases 14% YoY in DLD’s Private Data set KBRA DLD tracked $3.8 billion in new-issue volume last month across sponsored, U.S. borrowers. Managers said new business felt slower than usual for the start of the year, and indeed, the tally in our Private Data set was down 14% from January 2022. The…