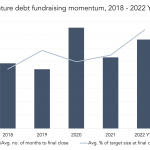

The Pulse of Private Equity – 12/12/2022

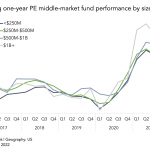

Will middle-market fund performance remain more resilient? Download PitchBook’s Report here. Private market funds are due for a downturn, but there may be nuances. Shielded thus far from public markets’ volatility by sheer dint of their at-minimum quarterly markings, private pools of capital are likely going to begin seeing markdowns in performance let alone portfolio value…