PDI Picks – 11/28/2022

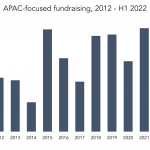

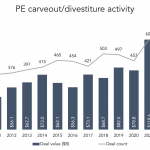

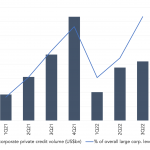

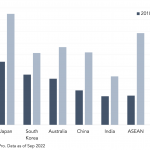

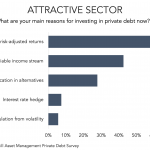

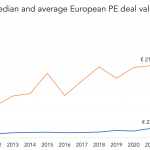

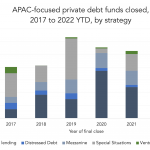

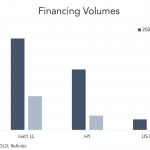

Investors fix gaze on Asia-Pacific As private debt matures, under-developed markets in Asia and Europe are expected to come into their own. In a newly published report on the state of private credit, the Alternative Credit Council foresees the growth of private credit beyond the favoured markets of the US and UK. Many of the…