The Pulse of Private Equity – 10/17/2022

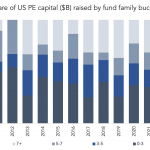

Familiarity a plus Download PitchBook’s Report here. PitchBook’s Q3 2022 US PE Breakdown, available for free, crystallizes a trend we’ve been hearing about in recent months. Even by historical standards, fundraising is lopsided in favor of existing GP managers. So far this year, almost half (48%) of fundraising dollars have gone to established firms—in this case,…