Private Debt Intelligence – 10/3/2022

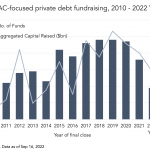

NA private debt deal activity struggles to catch up with 2021 highs Private debt deal activity in North America has slowed in the second half of 2022 so far, with the number of deals dropping to just over 100 in Q3 this year. Since the recent high of $78.8bn in Q2 2021, aggregate deal value…