The Pulse of Private Equity – 9/12/2022

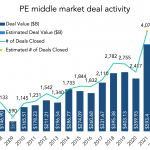

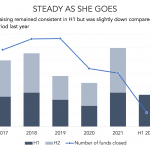

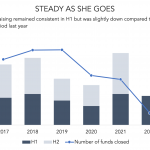

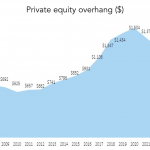

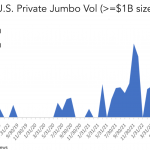

Dealmaking steady, fundraising slows Download PitchBook’s Report here. PitchBook’s Q2 2022 US PE Middle Market Report is now available. All things considered, dealmaking was stout in H1. Over 1,600 transactions were finished, with $228.2 billion invested in the process. Both figures are strong relative to prior years, except 2021. At this pace, the middle market is…