Leveraged Loan Insight & Analysis – 8/15/2022

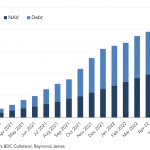

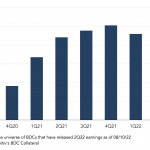

Blackstone Private Credit Fund continues to grow Perpetual-life BDCs continue to pull in money, with these funds accounting for the majority of recent growth in the BDC space. In addition to enticing investors with attractive yields like all BDCs, perpetual-life BDCs continually offer new shares monthly and provide investors with quarterly liquidity through a share…