DL Deals: News & Analysis – 7/18/2022

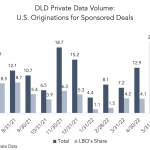

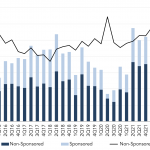

Private lending volume posts strong quarter, but a slowdown lies ahead Direct Lending Deals’ Private Data set picked up $56.9 billion in sponsored U.S. loan volume during the second quarter, to rebound from a weak first quarter of $20 billion, and beat the $40.4 billion recorded during the private lending binge that drove the final…