Private Debt Intelligence – 3/21/2022

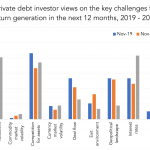

Private debt investors’ rising concerns over interest rates The US Federal Reserve approved a 0.25 percentage point interest rate hike on March 16. Private debt investors are protected from the negative consequences of rising interest rates by floating rate agreements. However, rising rates also increase default risk which can fundamentally damage portfolio performance…. Subscribe to