Leveraged Loan Insight & Analysis – 12/6/2021

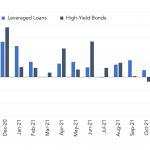

US leveraged loan and HY bond returns bounce back in December Leveraged loans posted their worst month of post-pandemic returns in November, at -0.16%, according to the S&P/LSTA Leveraged Loan Index, while US high-yield bond returns slumped 1.02%, their second consecutive month of negative returns, according to the ICE BofA US HY Index…. Subscribe to