Private Debt Intelligence – 11/22/2021

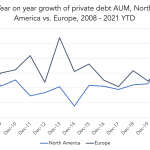

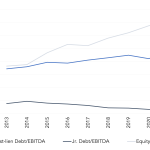

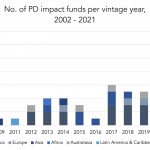

North American private debt AUM growth vs. Europe Up until the Global Financial Crisis, the majority of Europe-focused financing came from banks. After 2008, borrowers were forced to turn to other sources of debt finance as banks tightened the purse strings. Since then, the private debt industry in Europe has grown a lot, with AUM…