Leveraged Loan Insight & Analysis – 6/28/2021

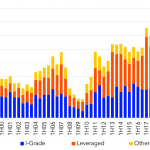

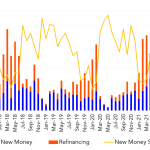

1H21 U.S. loan volume up 58% y-o-y; Second highest total on record U.S. arrangers pushed almost US$1.466trn through the retail syndication in 1H21, a 58% increase over the same period last year and the strongest half year totals since 1H18 (US$1.492trn). At US$764.10bn, 2Q21 syndicated loan volume marked a two fold jump over year ago…