Private Debt Intelligence – 6/14/2021

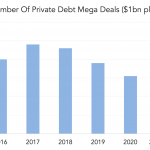

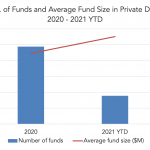

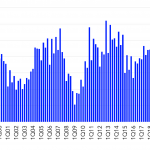

Mega deals on upward trend in 2021 The number of mega private debt deals (transaction of $1bn+) had been steadily decreasing since the 48 mega deals that were completed in 2017, but H1 2021 has seen an uptick in activity. Last year, the average deal size stood at $85m and 2020 saw 31 deals with…