Private Debt Intelligence – 5/3/2021

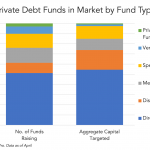

Distressed debt funds average largest targeted fund size Although distressed debt strategies account for only 10.1% of 592 private debt funds in market, they are targeting 19.3% of aggregate capital. Distressed debt funds have the biggest average target fund size, at $1.4bn. By contrast, venture debt funds are 7.1% of the number of funds, but…