Private Debt Intelligence – 3/29/2021

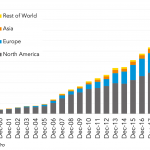

Private Debt Assets under Management by Geographic Focus, 2000 – 2020 While funds focusing on North America constitute 61% of total AUM, other regions have gradually expanded their share. This is particularly the case for Europe-focused AUM, which now makes up just under 30% of the total… Subscribe to Read MoreAlready a member? Log in