Private Debt Intelligence – 9/28/2020

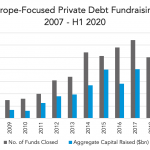

European Private Debt AUM Reaches Record High Figures European private debt AUM has shown enormous expansion in recent years. It has more than doubled since December 2014 and more than tripled since December 2012, reaching €179bn as of December 2019. However, seems that the presence of attractive opportunities has made the dry powder fall…. Subscribe