Leveraged Loan Insight & Analysis – 7/7/2025

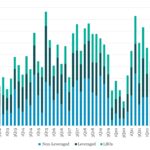

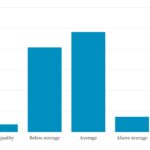

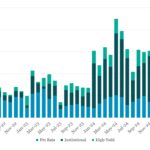

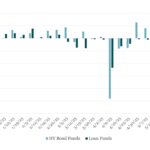

As overall issuance slips in 2Q25, strategic M&A remains a bright spot for LevFin market Leveraged finance issuance topped US$343bn in 2Q25, down approximately 30% from 1Q25 and off nearly 40% versus 2Q24…. Subscribe to Read MoreAlready a member? Log in here...