Leveraged Loan Insight & Analysis – 3/16/2020

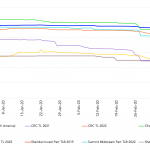

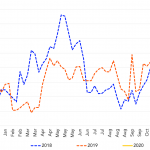

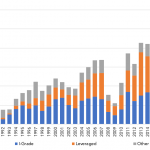

CRC and Chesapeake TLs lead largest losers in falling oil and gas loan prices As oil and gas companies try to weather these tumultuous times, some investors are worried that reduced revenue may push some oil and gas issuers to default on their corporate debt. This concern has been pushing oil and gas loan prices…