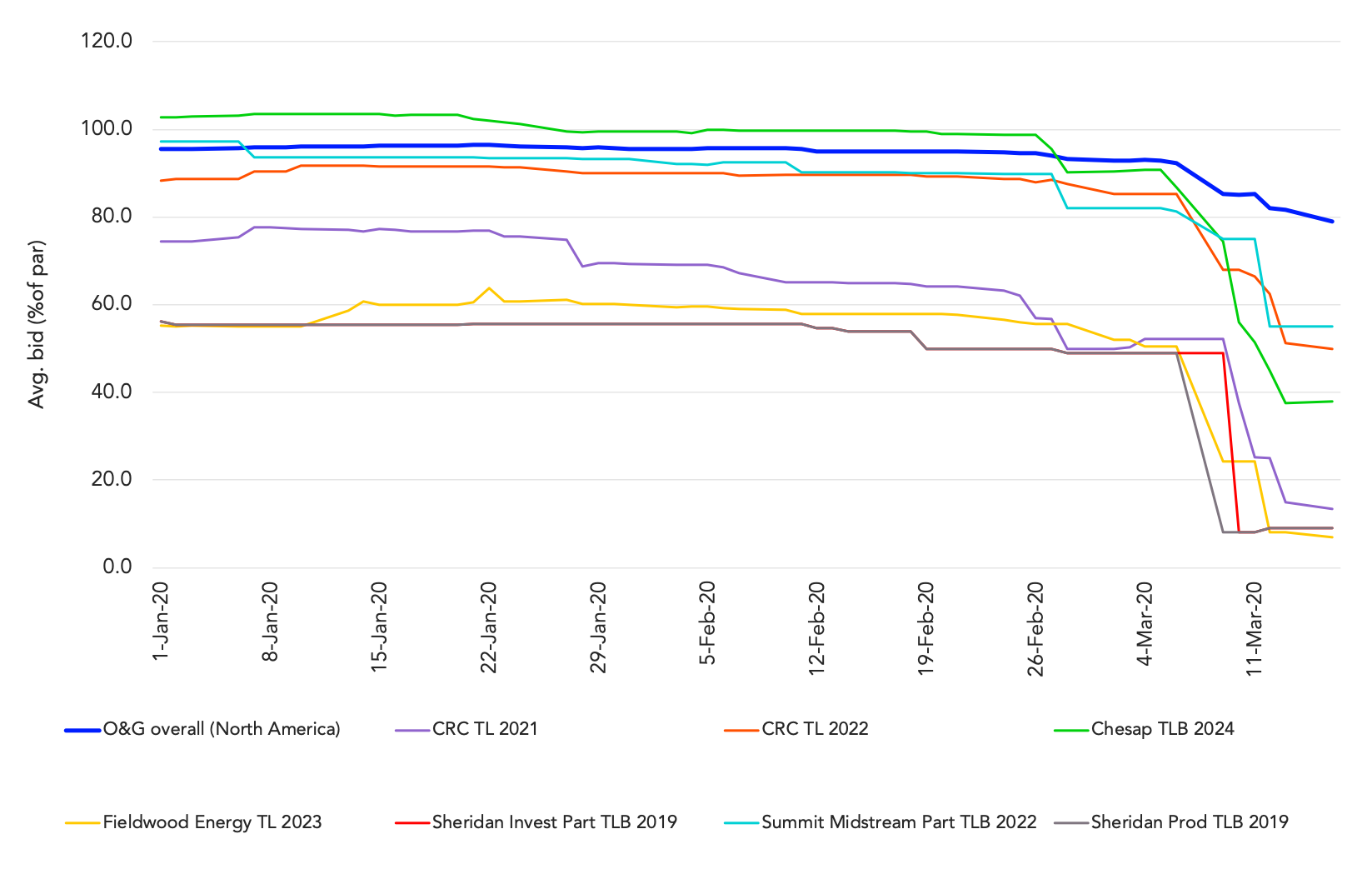

CRC and Chesapeake TLs lead largest losers

in falling oil and gas loan prices

As oil and gas companies try to weather these tumultuous times, some investors are worried that reduced revenue may push some oil and gas issuers to default on their corporate debt. This concern has been pushing oil and gas loan prices down dramatically. In the last 30 days, 92% of oil and gas loans priced by LSTA/Refinitiv LPC MTM Pricing declined, while only 1% advanced (7% were unchanged).