Leveraged Loan Insight & Analysis – 4/28/2025

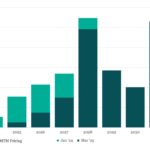

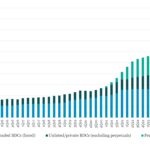

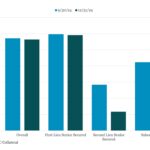

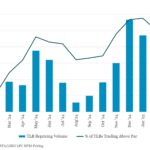

BSL lenders support over US$405bn in new lending activity YTD; Several M&A opportunities bypass BSL market US lenders have been tapped for nearly US$406bn in new loan assets so far this year via the broadly syndicated loan market…. Subscribe to Read MoreAlready a member? Log in here...