The Pulse of Private Equity – 1/30/2023

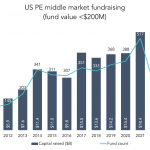

A big drop for small funds Download PitchBook’s Report here. Another 193 middle-market funds closed last year, according to PitchBook’s latest US PE Breakdown. Collectively the funds are worth $161.5 billion—both figures being in line with prior years. But fundraising at the smallest end of the market didn’t fare as well. Among funds of $200 million…