The Pulse of Private Equity – 5/10/2021

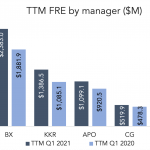

A good start to the year for public PEGs Download PitchBook’s Report here. The “Big Five” PE firms that trade publicly—Blackstone, KKR, Apollo, Carlyle and Ares—had an impressive start to 2021. PitchBook’s latest analyst note takes a close look at their Q1 2021 financials, which showed sustained momentum coming out of the pandemic late last year….