The Pulse of Private Equity – 6/23/2014

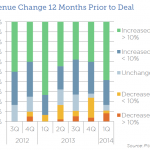

Over the last several years the biggest opportunity for PE firms was in solid companies that were struggling with generating growth and then to use their operation expertise to fix it up in order to… Login to Read More...