The Pulse of Private Equity – 2/21/2022

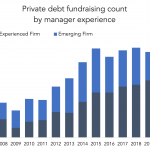

Fewer emerging lenders in 2021 Download PitchBook’s Report here. 2021 marked a decade low for “emerging firm” private debt fundraising, according to PitchBook’s Annual Global Private Debt Report. Only 64 private debt funds were raised last year by emerging firms, down from 145 in 2020. Before 2021’s slowdown, emerging lenders raised at least 100 private debt…