The Pulse of Private Equity – 9/13/2021

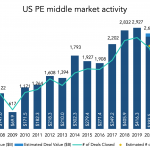

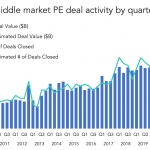

Another frenetic quarter for the middle market Download PitchBook’s Report here. PitchBook’s latest US Middle Market Report was released today. The frenetic pace of dealmaking continued into the second quarter, reaching an estimated $142.8 billion. That would mark the second highest quarterly total on record, behind Q4 2020’s $156.8 billion. Sandwiched between those two was a…