The Pulse of Private Equity – 6/14/2021

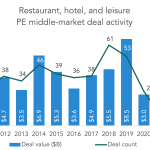

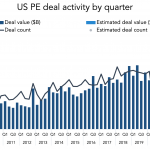

COVID’s impact on restaurants, hotels and leisure Download PitchBook’s Report here. PitchBook’s latest US Middle Market Report was released this week. Middle-market trends were in line with broader PE trends, with Q1 notching the second-highest totals ever seen, behind the record-breaking fourth quarter. We’ll re-visit other themes in the report next week. One of the spotlights…