The Pulse of Private Equity – 1/25/2021

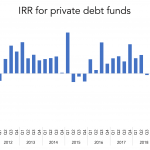

-6.2% Q1 performance for private debt Download PitchBook’s Report here. Private debt performance struggled in Q1, according to PitchBook’s just released Global Private Debt Report. Globally, private debt funds recorded a 6.2% drop in IRR in the first quarter. While not surprising, it was the worst quarterly performance since the financial crisis, when reliable performance data…