The Pulse of Private Equity – 5/18/2020

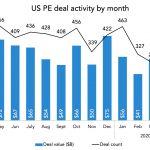

April was down, as expected Download PitchBook’s Report here. An early look at April 2020 deal volume shows the significant decline we’ve all been anticipating. Only 158 transactions were completed last month, less than half of the typical monthly volume we were seeing pre-pandemic. As we’ve noted in the past, some of these deals were announced…