The Pulse of Private Equity – 5/6/2019

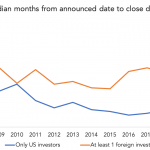

A closer look at foreign investment There’s a tradeoff between welcoming foreign investment and protecting national security. That’s becoming a more common tradeoff to consider in the private equity world, where foreign investors are keen to get involved in direct investments…. Subscribe to Read MoreAlready a member? Log in here...