The Pulse of Private Equity – 10/23/2017

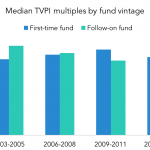

Feels like the first time Download PitchBook’s Report click here. Like Aaron Judge of the New York Yankees, rookies are sometimes better than the veterans. In our latest Analyst Report, we analyzed first-time PE fund returns against the broader PE landscape. Even with the disadvantages that come with rookie funds—less experienced staff, smaller infrastructure, fewer…