The Pulse of Private Equity – 1/8/2018

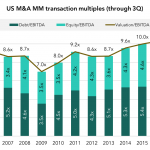

Why is PE so optimistic? Download PitchBook’s Report click here. Our friends and clients in the PE industry are a cheery bunch. No matter how much we analysts fret about deal multiples or the tepid exit market, buyers and sellers find reasons for optimism. Exhibit A comes from our latest PE Deal Multiples Report, released…