The Pulse of Private Equity – 7/24/2017

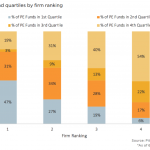

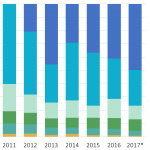

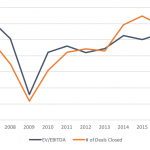

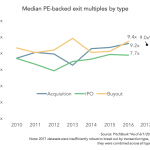

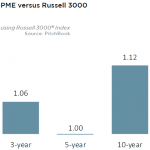

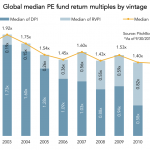

PE is consistent, even against Russell View PitchBook’s Research Note Here Is private equity performance consistent? Managers will tell you yes – according to marketing materials, nearly every manager boasts of top quartile performance. Squishy numbers and contestable metrics have clouded the industry for years, and investors apparently fall for them every cycle. … Login to