The Pulse of Private Equity – 4/2/2018

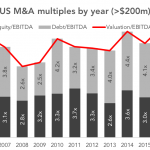

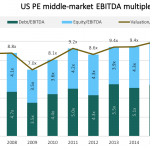

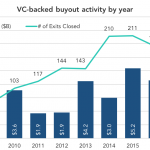

PE performance update Download PitchBook’s Report click here. The run-up in public market valuations and its impact on PE has been discussed ad nauseum. Much of that impact has been negative, especially around multiples and a lack of suitable entry prices. PE’s strong suit has historically been the turnaround play—buy low, get your hands dirty,…