The Pulse of Private Equity – 3/6/2017

Demand for PE exposure to slacken eventually?

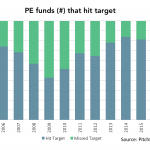

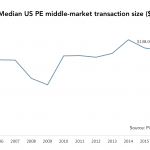

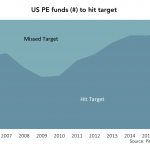

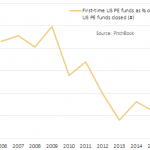

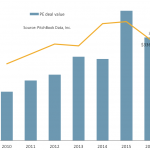

In 2016, 87.6% of private equity funds that closed in North America and Europe hit or exceeded their targets. Even compared to the heights of 2014 and 2015, that figure represents a clear high of the decade, and, moreover, the extent to which limited partners of multiple types are eager for exposure to the PE asset class. Given that 356 funds closed in 2016—a lower tally than observed in any of the three preceding years—but the average fund size soared to nearly $765 million...