The Pulse of Private Equity – 10/30/2017

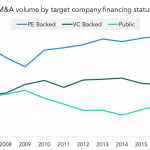

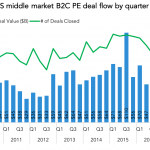

PE’s growing influence on M&A Download PitchBook’s Report click here. Private equity holdings now make up 11% of all target companies in the M&A market. That percentage was a good deal smaller in the not-so-distant past, but the share of PE-backed M&A targets has steadily increased since the financial crisis. Simple arithmetic explains part of…