The Pulse of Private Equity – 5/9/2016

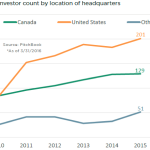

U.S. PE firms pull back in Canada Last year saw a decade high of 201 U.S.-headquartered private equity firms invest in Canada, far outstripping the 129 domestic firms that were active in the same timeframe. Through the end of 1Q 2016, however, U.S. and Canadian PE firms are nearly evenly matched. This equalizing occurred as…