The Pulse of Private Equity – 8/15/2016

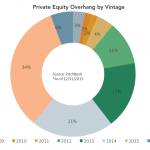

What does PE’s capital overhang portend? Through the end of 2015, the private equity industry in North America and Europe had an overhang of no less than $749.4 billion. A plurality of that is concentrated in funds of the 2015 vintage, with a majority—55%—in funds closed in the past two years (funds return data is…