Private Debt Intelligence – 2/19/2018

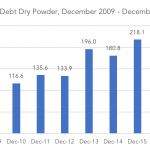

European Private Debt Deals Increased private debt financing over the past seven years can be largely attributed to the continuing retreat by banks from loan markets under the pressure of tougher capital rules. As a result, private equity transactions and corporate acquisitions, which were largely financed by banks in the past, are increasingly backed by…